Welcome to Wealthcommon Currency Central

|

In earlier America, the American dollar was derived from an established amount of

gold or silver based on the popular coin of colonial times -- the Spanish

milled dollar. Paper receipts for gold and silver

warehoused by private enterprises and private banks circulated in the

first part of the 1800s. Before the Civil War, both private mint

and government precious metal coins were in circulation together. The private mintage actually had a knack

for containing a little more silver and gold. These are examples where

the currency in America had physical limits on production and

thus a natural rarity, true value and stability from an

'organic' base.

However, there were times in American history where the currency

caused trouble and chaos. One was the Continental currency: a paper-only

money printed during the Revolutionary War. States printing their own money

contributed to the inflationary loss and economic hardship during and after those times. Then three

national central banks successively rose and fell suffering the fraud, scandal and inflationary

consequences of their paper monies. When the Civil War came

about, paper money was issued which resulted in inflationary economic

hardships that undoubtedly made reconstruction more difficult.

In other times, history has recorded the debasement arising from such paper

money systems like Argentina's relatively recent banking crisis, pre-Nazi Germany,

18th Century France, the Russian Federation's ruble and from long ago the

clad-metal debasement of Roman coinage which accompanied the empire's downfall.

Let us instead adhere to a system of exchange where the face value of the currency

is much better proportioned by precious metals instead of using today's intrinsic low value

notes riddled with national debt.

|

Current Conversion Rate:

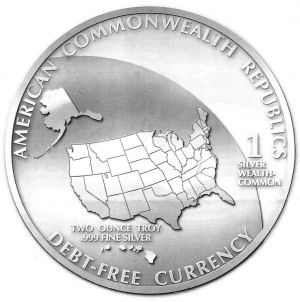

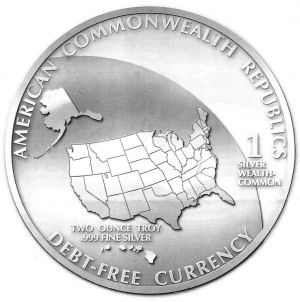

1 Silver Wealthcommon (2 oz.) >> Worth its retail weight in silver plus any collector's value. |

Know This...

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/tny_ag_en_usoz_2.gif)

|

So it appears that even with an accompanying explanation about the collective bankruptcy brought about

by un-backed, debt-paper dollars -- circulating a particular bullion just will not catch on with the masses to prevent our dollar demise. This is not

too surprising with the government and banking system's money monopoly having advantage in centralized

mass production and convenience plus general ignorance and apathy of the populace.

Despite selling wealthcommon rounds at a higher face value to

prevent incentive of melting them down or due to that, we acquiesce to Gresham's Law.

|

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

|

|

We note that cryptocurrencies have had some success though with periods of volatility. However,

cryptocurrencies unlike tangible precious metals rely on having electricity, internet access and the

infrastructures to transact. What if the lights go out or some authority can legally (or otherwise) impede or turn

off the switch?

|

|

|

As no wealthcommons have been put into circulation, we are free to end this endeavor without obligations; however,

the relevant parts of this webpage can remain as an illustration of the concepts with any necessary updates. It may be

easier to attempt local alternative currencies to the Federal Reserve System as some have had

temporary success.

|

|

|

Though the dollar's downfall has still not come as anticipated, it cannot go on forever based on such high

debt levels. Depending on economic trends, perhaps there is much more time to come

or there is possibility of a turn-around if reforms are enacted. It may be the case that it will not go out with a

bang but more of a whimper - just the constant slow devaluations over time until something replaces it. Hopefully

the occurrence will be in such a way as for us to have plenty of time to prepare and to address lowering our debt

levels. God speed good friends............

|

|

Ask Yourself About the Dollar and what was proposed as the Wealthcommon:

|

(1) Do you prefer an unbacked currency issued by a manipulative, private bank monopoly masquerading as an official

government department whose notes accommodate the phony promises of

bankrupting politicians who:

- Gave us the paltry, failing Social Security system?

|

- Waste and overspend government revenues?

|

- Use trickery and deceit in their accounting and budget practices?

|

- Flaunt corporate welfare and bailouts?

|

- Created the punitive, convoluted income tax code, I.R.S.

and the welfare state?

|

Would you prefer a currency dependent on precious metals?

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

(2) Do you want to circulate a currency whose buying power falls

long term due to inflation and its debt base?

Do you want to circulate a more stable currency whose buying

power can rise -- especially in the bad times likely to come because of the

national debt, our debased fiat reserve notes and government mismanagement of our economy?

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

(3) Do you trust the nation's currency loaned from

foreigners and banksters which has no direct commodity backing where the paper version's

intrinsic production value has been quoted at a mere 3 cents?

Do you trust a silver currency that is debt-free whose

silver content and production cost is more proportioned to the face value

which is set adequately higher to stabilize the currency above common fluctuations

in precious metal cost, prevent meltings and which acts to limit its issuance when silver corrects?

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

(4) Should you depend on a currency that is a high credit

or debt instrument

favoring the banksters who issue it? This is not to mention the foreign and domestic sponsors who loan

it out while it heads for collapse.

Should you depend on a currency that can preserve its buying power

and is upward buoyant since silver is destined to soar higher at the dollar apocalypse?

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

(5) Do you want an unconstitutional, illegal currency due to

its nil precious-metal backing whose issuance is controlled by a constitutionally unauthorized

bank association granted power by an abrogating Congress and the deposits of which are allocated within a fractional

reserve (musical chairs) banking scheme?

Do you want a legal, precious metal, private

currency that is not a mechanism of collusion between politicians and

banksters?

If you said yes to the latter arguments, then the proposed Wealthcommon

is your more favored currency.

.....Forget the Dollar

Imagine if your employer asked that instead of giving you paychecks, they could give

you a cash advance off a company credit card where you would pay the interest.

Every subsequent

cash advance you got in compensation as wages would

automatically deduct a minimum based on the interest of previous cash advances given as pay.

Would you agree to that deal? Of course not! Yet, when you accept the current

US dollar - you are accepting a note or bill that is basically a collective promise to pay off

the interest on a cash advance from the Federal Reserve 'credit card'.

Whenever the politicians

need to create easy money to prime the economic pump which helps them spend on otherwise unaffordable pork and spending programs, they too

implement the Federal Reserve's cash advance system.

Even with overall economic growth,

the more money created to sustain economic circulation is also distributed as a cash

advance to the masses!

|

Endgame for the U.S. Dollar:

|

A silver or gold currency's intrinsic value is tangible, foundational and inseparable.

If the powers at-large want to take advantage of you, then they will

implement an unbacked paper and digital currency whose value is based more upon declaration (fiat).

Such a currency circulates today that is linked to a national

account where they can make secret deals in smoke-filled rooms, spend thrift

into debt while appearing to keep financial stability by paying you

with more of their unbacked paper and digital ' I.O.U.' money. This is the currency we have

today -- Federal Reserve Notes.

The Federal Reserve is akin to a national credit card where every dollar

is distributed with interest due, paid back to holders of Treasury Bonds (or securities).

Politicians can make vast promises and they gain much power

by implementing the unbacked paper and digital money. If the economy falters, there

is the temptation to simply print/upload more easy money to keep things rolling.

Consequently, as time passes the ratio of actual labor and production to the amount of

money in circulation drops. The aggregate interest and debt owed to the backers of the

easy money increases and the long-term value of the currency lowers which reflects this collective

monetary policy of the nation.

Luckily in the U.S. this monetary cycle has been greatly stretched out,

but nonetheless the eventual end is the same for even a wealthy, superpower

nation with a good work ethic. America has been vastly drained of vitality

from such an unbacked paper and digital money system. And that's not only in economic terms but social terms

as well. Unbacked money concentrates easier wealth in the

hands of some elites and worsens conditions for the poverty level. The more easily accommodating money supply

amplifies the absurd luxuries of elites and their wannabes while cheapening

the culture as a whole. Look around at some of the notorious examples of today's

lifestyles of affluent depravity and chrome-plated degenerates.

It is obvious why the checks and balances of a precious metal money

system drove the writers of the Constitution to demand such a money for

the use of the nation.

Lawful Currency Attributes.

|

Visit the links below to learn more about precious metals, alternative currencies,

strategic financing and other issues concerning your money.

Remember that as a personal investment commodity, precious metals can

include risk as there will be times of volatility, downturns and corrections even

in a bull market which will also provide you with great opportunity to the upside.

So do the research, mind the trend and weigh risk and incorporate any disclaimers

concerning anyone's predictions & opinions. You are responsible in the end for your investment

actions. The larger the sum to invest and more intricate the matter, you may want to consider

if you should consult some type of trustworthy personal investment advisor who is in business as such with some accredited title and who

has good knowledge and track record for the markets you get into.

ADVISORY: GOLDMONEY GOT BOUGHT OUT AND HAS ATTAINED A REVIEW

RECORD OF REFUSING TO RETURN DEPOSITORS' FUNDS WHILE MAKING ALL KINDS OF EXCUSES AND RUNAROUNDS FOR NOT RETURNING PEOPLE'S MONEY. REGARD AS

A SCAM. DO NOT DEPOSIT FUNDS THERE.

Kitco monitors precious metal markets

everyday plus they have loads of information with articles, graphs and links for precious metal

investors. They also sell gold/silver coins & bullion.

Swiss America: Buy & sell precious metals with news & commentary. - 'To educate and prepare our clients on how precious metals - in physical form - offer asset protection,

security, profit potential, privacy of ownership and peace of mind as well as offset the liabilities of owning other assets.'

BullionVault - 'BullionVault is the world's largest online investment gold service taking care of $2 billion for more than 70,000 users. It is part-owned by both GBIT and Augmentum Capital.'

SD Bullion is what the doctors ordered. They also sell colloidal silver, survival food and as

predicted what will become a form of currency in tough times as well -- ammo. They claim to be the lowest-cost online retailer.

JM Bullion is a precious metal dealer who offers a guarantee of selling at the overall lowest price relative to spot when the same

level of shipping and insurance applies for the matching particular goods of their competitor's. This does not apply to any competitor's forward selling.

Provident Metals has a good general selection of bullion and coin in a warehouse-type setting.

APMEX has a vast selection for various coins and bullion. Some

are foreign or historic. Look for showcase specials. You may also find novelties and accessories like

banknote sets or plastic bullion cases.

Goldline is a buyer and seller of precious metals with some special

products and offers.

Schiff Gold (formerly Euro Pacific Precious Metals) is the precious metal seller associated with commentator Peter Schiff.

They sell only non-numismatics and do not transact online but instead rely on phone

orders and seek to sell their inventory at low prices.

Goldmasters is an online

seller for gold, silver, palladium and platinum coins and bullion. Notice their shipping charges

and their quotes and premiums over spot price.

Sunshine Mint makes bullion products and

custom mint designs. Minimum order requirements may apply. Check with them

to find out.

Wholesale Coins Direct not only sells precious coins and bullion, but they

also sell diamonds and offer insurance and storage through their partners.

Scottsdale Silver has some interesting

bars and mintage of their own unique design that you may want to check out.

The Equity Trade Note issued by Dan El

Private Estates is a novel way to circulate gold. Since gold is the most malleable metal, it is possible to laminate an

"embossed" foil between paper and polymer and then circulate that as true money. Brilliant!

Valaurum too produces a thin foil certificate made of gold called the Aurum\AE. It is sold

by Sprott in North America. At time of initial post, it is the smallest physical weight of gold for sale on the world market.

Commodity Discs are silver bullion that have a smart phone code on the back which adds five dollars to the spot price of silver in order to

establish a transaction value.

Shire Silver is a commodity currency which uses strips or wires of silver or gold embedded into a plastic card

which denotes the weight.

Liberty Dollar silver and gold rounds began circulation by an organization formerly known as NORFED (Nat'l Organization for the Repeal of the Federal Reserve).

Northwest Territorial Mint sold

gold and silver coins plus bullion. They did custom minting as well. Very sad they went

out of business but their dies were purchased by Medalcraft Mint.

Bitcoin is a grassroots, decentralized cryptocurrency. Its supply is controlled by digital

"mining" and its value maintained by inherent scarcity, usefulness and real-world supply and demand.

American Bullion specializes in transferring typical

IRAs into the gold and silver variety.

Goldseek is an

investor-oriented site that relays all kinds of information about the gold market. For

silver there is Silverseek.

Bullion Exchanges

and 321Gold

offer similar links, information and charts like Goldseek and Kitco plus some of their

own unique contributions and different sources to visit.

Antarctica Dollars are a collector issue on polymer

paper. They are exchangeable for U.S. dollars and have been sent to Antarctica.

MoneyArt is an artist's site depicting the look of

imaginary but convincing currencies - some with a social commentary.

Barter News illustrates the advantages of using barter perhaps in the form of business scrip or "company

money".

List of Community Currencies in the U.S. has a good number

of entries but many are inactive.

Economic Collapse Blog: 'Are You Prepared For The Coming Economic Collapse And The Next Great Depression?'

Dollar Collapse is a site managed by a co-author of a

book on the same topic.

Shadow Government Statistics illustrates that what the government tells

us about the economic indicators and any justifications for our monetary policy are pure bunk. See

what our true unemployment, inflation and other figures are as opposed to the quotes based on the "inventive"

government formulas.

Coinflation demonstrates how low the value

of our clad coins is to the face value minted on them. Historic dimes, nickels and quarters are

quoted according to the value of precious and commodity metals they once held. The comparison shows

how our money has been debased and the loss of purchasing power of today's dollars.

Bank Implode monitors the banks to see which ones are in threat of collapse. Is your

bank really safe enough to keep your money there?

Austrian economics should be studied and pursued. Learn about its attributes and principles and how it came into being. Comparisons are made to other schools of economic

thought. Note the section on inflation and its causes and effects.

Cryptostashed is a site about various cryptocurrencies.

Mexican Civic Association For Silver makes the case

for the Mexican banks to circulate silver in the national interest. Silver is a Mexican resource and has had

a significant role in its history.

GATA which stands for Gold Anti-Trust Action Committee was formed to expose and take court action against large institutions

who they suspect flood markets with gold in order to illegally suppress the price.

FairTax advocates an end to the abusive and

burdensome income tax and to the I.R.S.

After checkout, the cost of new retail items is

nearly the same as when they rung up during the income tax era; however, one's paycheck no longer deducts federal withholding.

The Street & Investors Business Daily are all-around market and economic info sites for investors and business interests.

Wealthcommon Currency Central

last revised July 2024

|